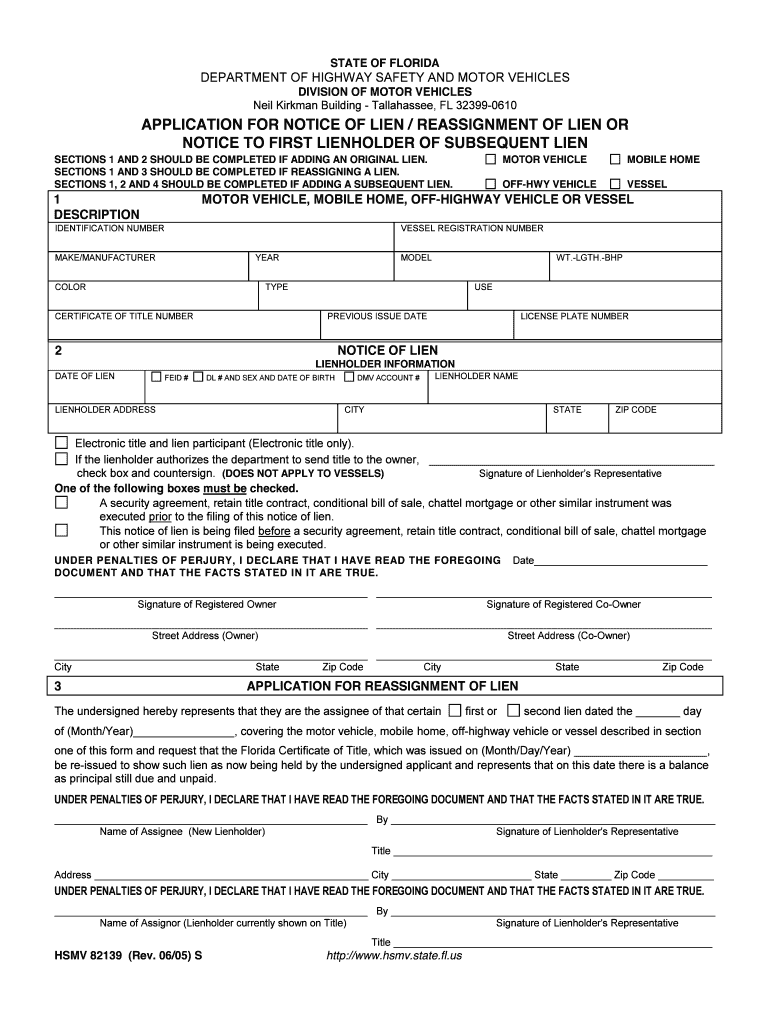

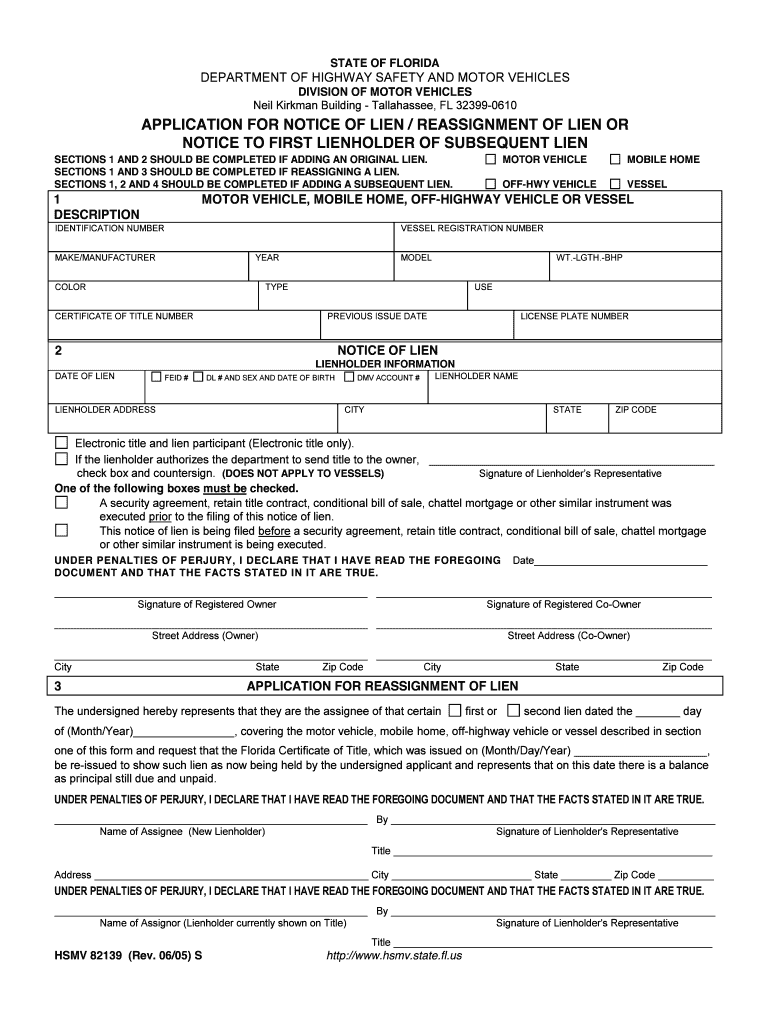

Get the free notice of lien florida form

Get, Create, Make and Sign

How to edit notice of lien florida online

How to fill out notice of lien florida

How to fill out a notice of lien form:

Who needs a notice of lien form:

Video instructions and help with filling out and completing notice of lien florida

Instructions and Help about notice of lien florida

Welcome to the Glenn Rasmussen Forgetting hooker podcast series my name is Trans Connie and today's topic will be notices to owner now when you're talking about a notice donor you're referring to Florida construction lien law in particular you're talking about Section seven thirteen point six Florida Statutes now that statute has everything that you need in order to understand how to properly serve a notice donor it tells you the form you need to use how to go about serving it and who is entitled to receive it so if you ever have a question about notices down or make sure you check out seven thirteen point oh six Florida Statutes what is a notice donor I noticed donor is a document that those Lenore's that are not improving with the owner are required to serve before they can perfect their lien what does that mean that means if you are a subcontractor a sub subcontractor or a supplier to a prime contractor or a subcontractor or a sub subcontractor those types of potential lien ORS anyone that doesn't have a direct contract with the owner has to serve a notice donor the newest owner must be served within 45 days and no later than 45 days from the first day of work or the first day of supplying materials, and it must be served on everyone upstream so for example if you are a sub subcontractor you'd have to serve it on the subcontractor the prime contractor the owner and anyone that's listed on the notice of commencement that's entitled to receive the notice to order how do you go about serving it I generally serve a notice to owner certified mail return receipt requested the statute says that you can serve it in other ways, but this is usually the most cost-effective and the most prevalent form of service when you're serving at certified mail return receipt requested you normally get a green card back that indicates who received it and when they received it so if there's ever an issue as to service you've got that as evidence a few practice pointers and things to keep in mind first is that when you are serving a notice to owner make sure that you serve it and have it in their hands within 45 days do not wait to the 45th day to drop it in the mail it must actually be received by everyone that's entitled to receive it within that 45 days second thing to keep in mind is make sure you properly identify the scope of work and your notice to owner I'll give you an example this is the current notice — owner form as of the date of this podcast there's a warning up top and down below it talks about the scope of work that you're going to be doing on the project let's say you start off a project, and you are doing roofing improvements, and you identify roofing improvements on the notice to owner halfway through the project the owner asks you to do some structural improvements well you would need to amend your notice donor to reflect that additional type of work otherwise you risk your lien being limited solely to the roofing improvement work that you did...

Fill form : Try Risk Free

People Also Ask about notice of lien florida

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your notice of lien florida online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.